Why Everyone Is Talking About Critical Illness Insurance (And You Should Too)

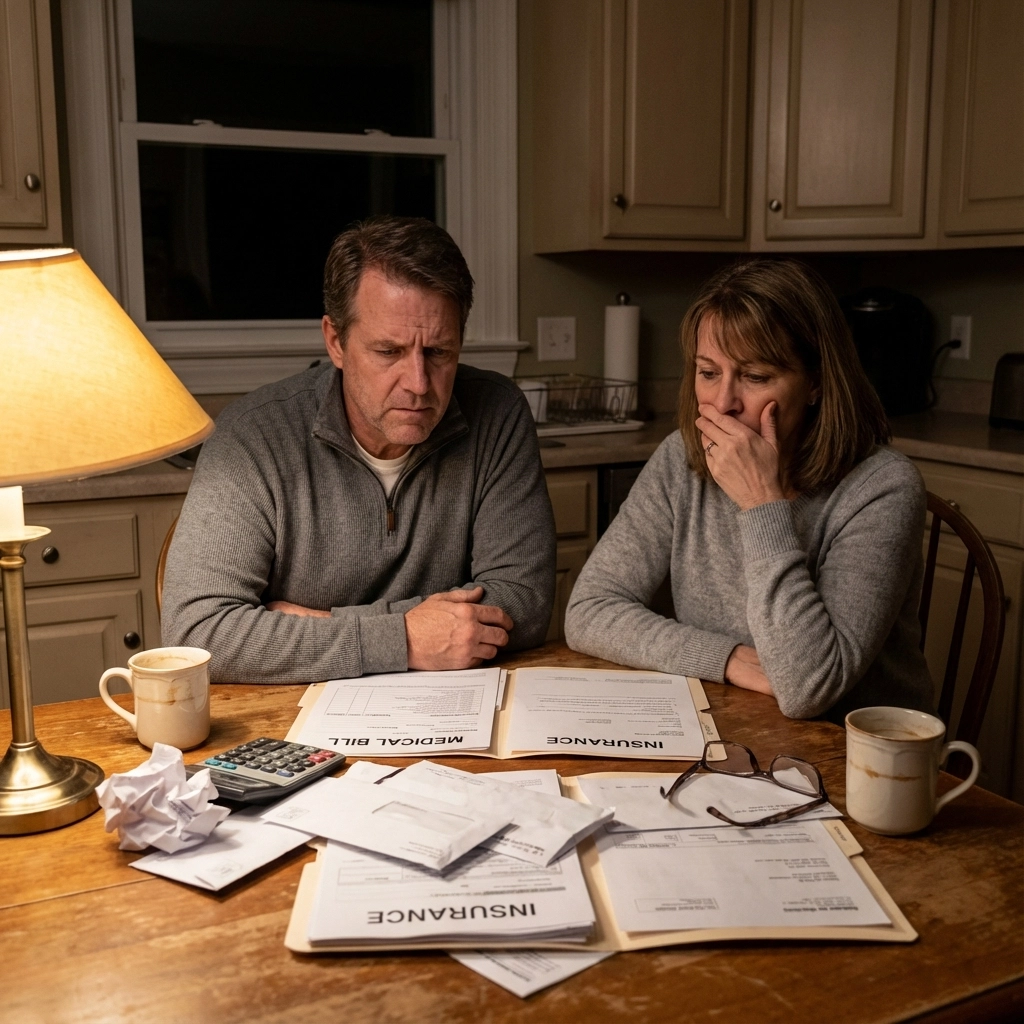

What if your family's biggest worry isn't whether you'll survive a serious illness, but whether you'll survive it financially? We understand that behind every sleepless night lies the fear of not just losing your health, but losing everything you've worked so hard to build for your family.

Right now, families across Texas are discovering a harsh reality: having health insurance doesn't mean you're financially protected when serious illness strikes. That's exactly why critical illness insurance has become the topic everyone's talking about – and why smart families are adding it to their protection plan before they need it.

The Gap That's Leaving Families Vulnerable

Your health insurance covers the medical bills, sure. But what about everything else? What happens when you can't work for months during treatment? Who pays the mortgage when you're fighting cancer? How do you cover childcare costs when you're recovering from a heart attack?

These are the questions that keep people awake at 3 AM, and they're the exact reasons critical illness insurance has moved from "nice to have" to "absolutely essential" for protecting your family's future.

The truth is, most families are just one serious diagnosis away from financial disaster – even with good health insurance. Critical illness insurance fills that dangerous gap by providing a lump-sum cash payment when you need it most, giving you the freedom to focus on what matters: getting better.

What Makes Critical Illness Insurance Different

Unlike your health insurance that pays doctors and hospitals directly, critical illness insurance puts cash directly in your hands. When you're diagnosed with a covered condition, you receive a tax-free lump sum that you can use however you need – no questions asked.

This isn't about replacing your health insurance. It's about completing your protection plan so your family doesn't have to choose between your health and your home.

The Big Five Conditions Everyone Worries About

Critical illness insurance typically covers what we call the "Big Five" – the conditions that strike without warning and change everything:

- Cancer (the most common claim)

- Heart attack

- Stroke

- Kidney failure

- Major organ failure

But coverage goes beyond these five. Most policies also protect against Parkinson's disease, multiple sclerosis, loss of sight or hearing, and many other serious conditions that can derail your family's financial stability.

Real Protection for Real Families

Let me paint you a picture of what this looks like in real life. Sarah, a teacher from Dallas, was diagnosed with breast cancer at 42. Her health insurance covered the treatments, but it didn't cover the three months of missed work, the special diet her doctor recommended, the extra childcare when she couldn't drive to pick up her kids, or the mortgage payment that kept coming every month.

Her critical illness policy paid out $50,000 within two weeks of diagnosis. That money didn't just pay bills – it bought her family peace of mind during the scariest time of their lives.

Why Families Are Adding This Protection Now

You Can't Predict When Illness Will Strike We all know someone who was perfectly healthy one day and facing a life-changing diagnosis the next. Critical illness doesn't care about your age, your fitness level, or your family history. It strikes when it wants to, and when it does, you need to be ready.

Health Insurance Isn't Enough Your health insurance handles the medical side, but what about the life side? The mortgage, groceries, utilities, and all the extra costs that come with serious illness – those are on you. Critical illness insurance ensures they don't become impossible burdens.

It's More Affordable Than You Think Many people assume this type of coverage is expensive, but it's surprisingly affordable – often less than what families spend on coffee each month. Especially when you consider what it protects, it's one of the smartest investments you can make in your family's security.

Common Questions We Hear Every Day

"Don't I already have disability insurance?" Disability insurance replaces part of your income if you can't work. Critical illness insurance gives you immediate cash to handle expenses right now. They work together, but they're not the same thing.

"What if I never use it?" That's the best-case scenario! But ask yourself this: do you hope you never use your car insurance? Of course. But you still pay for it every month because you understand the protection it provides.

"How quickly do I get the money?" Most claims are paid within 30 days, and many within just two weeks. When you're facing a critical illness, every day counts – both for your health and your finances.

The Peace of Mind You Can't Put a Price On

Here's what families tell us after adding critical illness coverage: they sleep better at night. Not because they want something bad to happen, but because they know that if it does, their family won't face financial ruin on top of everything else.

When you're lying in a hospital bed, the last thing you should be worrying about is how you're going to pay your bills. Critical illness insurance ensures those worries don't exist.

Making the Right Choice for Your Family

Critical illness insurance isn't just another policy – it's completing the safety net under your family's future. It's the difference between fighting illness and fighting illness while drowning in financial stress.

The families who are talking about this coverage aren't waiting for the perfect time to add protection. They understand that the perfect time was yesterday, but today is the next best option.

Your Family's Security Starts With One Conversation

You've worked too hard building your family's life to let one diagnosis tear it all down. Critical illness insurance isn't about planning for the worst – it's about ensuring that even in the worst-case scenario, your family's love and security remain unshakable.

We're here to help Texas families understand their options and find protection that fits their needs and budget. Every family's situation is different, which is why we take the time to listen and create a personalized protection plan that gives you confidence in your family's future.

Don't let another day pass wondering "what if." Contact us today to discuss how critical illness insurance can complete your family's protection plan. Your future self – and your family – will thank you for taking this important step while you still can.

Because when it comes to protecting the people you love most, there's no such thing as being too prepared.

Add comment

Comments